Final 3 Down Payment Program Myths Debunked

How do you go from dreaming of owning a home to holding your first set of keys? If you’re like most first-time buyers, the down payment is your biggest hurdle—but it may not need to be.

There are more than 2,000 homebuyer assistance programs available across the country. Let’s take a look at how the 3 most common types of programs work.

They are loans, grants, tax credits and other programs for eligible homebuyers that can help them achieve the down payment faster, cover closing costs and get into a home sooner than they would have otherwise.

Homebuyer assistance programs are managed and funded from an array of sources, each with its own requirements, nuances and limitations. The role of program administrators can vary, but generally, they approve participating lenders who are trained on the program guidelines and approved to originate, process and close specific programs.

You can work with a participating lender to apply and access down payment help or you can directly contact the agency offering the program.

Both you and the home you are purchasing must be eligible. Homeownership programs are for owner-occupant buyers only—no investment properties. You must make a minimum investment, qualify for a first mortgage and complete homebuyer education. Common eligibility factors include the home’s sales price, homebuyer income and homeownership history.

Your occupation can help give you a boost. There are often additional benefits, or even entirely separate programs, for educators, protectors, health care workers, veterans and households with disabled members.

It’s important to know that a first-time homebuyer is defined as someone who hasn’t owned a home in three years. So, if you owned in the past but are renting now, you may be a first-timer again! Plus, across our database of programs 38 percent don’t have a first-time homebuyer requirement.

The largest category of programs—74% to be exact—are down payment assistance and closing cost programs. Down payment assistance (DPA) is an umbrella term for programs offered by federal, state, county or local government agencies, nonprofits and employers. DPA programs come in 2 primary forms:

Grants are gifts at closing provided by an eligible third party to help cover the cost of some or all of your down payment or closing costs. They do not have to be repaid by the homebuyer, do not incur a lien on the property being purchased, and have no associated note or deed.

Many down payment programs come in the form of a second mortgage, or subordinate lien, with varying payback provisions.

Repayable DPA programs provide down payment funds at closing often as a 0%-interest second loan, but some may accrue interest and some may be amortizing loans. These programs typically range from 5-year to 30-year loans with varying repayment terms, which may start immediately or kick in after a predetermined period.

Deferred or silent second programs postpone repayment of the down payment assistance until the borrower sells, refinances, rents or moves out of the home. Buyers who plan to live in the home for several years will benefit most from the home’s appreciation in value.

Forgivable second mortgage programs forgive some or all of the DPA amount. When and how much of that down payment help is forgiven may vary, but it’s common for a percentage of the loan to be forgiven each year for a predefined number of years. However, if the program’s conditions are not met—for example, the buyer moves out of the home—the loan must be repaid, sometimes with interest.

Many larger housing finance agencies, particularly at the state level, offer first mortgages to accompany their down payment assistance programs. They are often funded by state housing finance agencies and may subsidize portions of the interest to offer rates below what the normal market can provide, helping lower your buying costs and monthly payments. They may also have reduced closing costs and fees and waive mortgage insurance requirements.

The USDA also has 2 first mortgage programs, the Rural Direct Loan and the Rural Guaranteed Loan, both primarily used to help low- and moderate-income individuals or households purchase homes in rural areas. Funds can be used to acquire, build (including purchase and prepare sites and provide water and sewage facilities), repair, renovate or relocate a home.

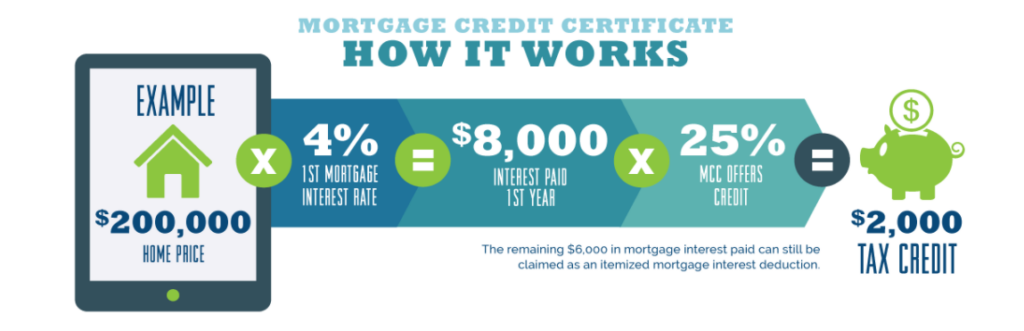

This annual federal income tax credit is designed to help first-time homebuyers offset a portion of their mortgage interest on a new mortgage as a way to help qualify for a loan. As a tax credit, not a tax deduction, the MCC helps reduce your annual taxes dollar for dollar.

The mortgage credit allowed varies depending on the state or local government that issues the certificates, but (in most cases) it is capped at a maximum of $2,000 per year by the IRS. MCCs can often be used alongside another down payment program.

Search for programs in your area that may be a fit for your situation. You can also look up your state’s Housing Finance Agency and view available programs. View the agency’s list of participating mortgage lenders and interview a few to find the best fit for you.

Never want to miss a post? For more useful down payment and home buying information, subscribe to our mailing list.