Final 3 Down Payment Program Myths Debunked

We know, saving for a down payment can be the most difficult part of home buying, especially for first-timers who don’t have the proceeds from a previous home sale to help with their down payment.

You may already be saving for retirement through your 401K or IRA. If it’s your biggest source of savings, you may be tempted to borrow from yourself to get that down payment now. But, should you?

According to Bank of the West’s annual Millennial Study, one in three Millennials dipped into retirement accounts to fund their purchase.

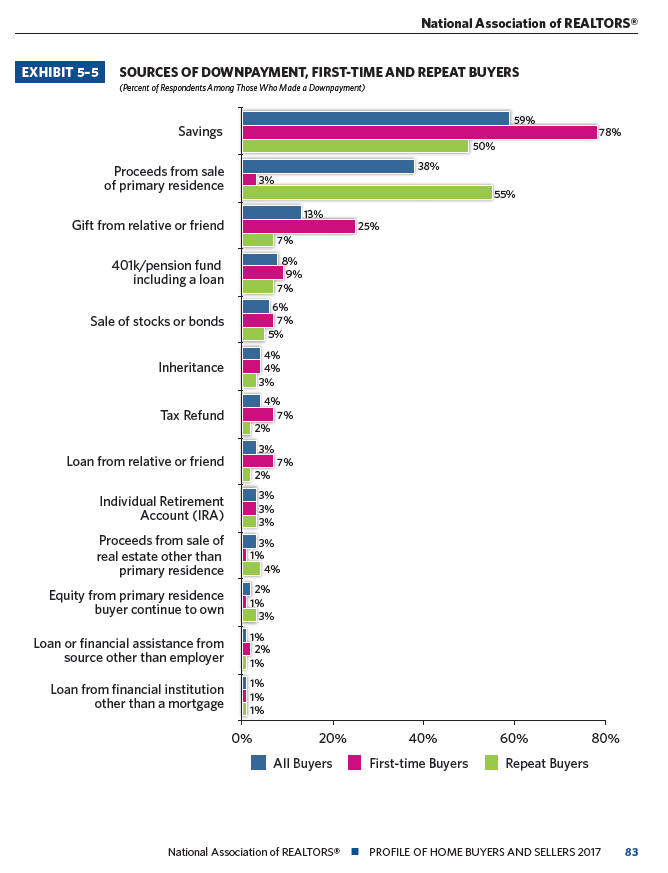

And, the National Association of REALTORS® Profile of Homebuyers and Sellers found that 19 percent of first-time buyers liquidated part of their 401K, stocks and bonds, or IRA savings to fund their down payment.

For many situations, the answer is no. Borrowing from your long-term savings negatively impacts the snowball (or compounding) effect of your 401K fund growth. The big idea being the earlier you start saving – even in small amounts — the greater your gains are each year putting you that much closer to meeting your retirement goals.

So, if you pull that cash out now, you’re back to square one with less time to build that snowball. And, none of us wants to be punching the clock post-retirement. Right?

Before you pull the trigger on using retirement savings for a down payment, do some research on the short and long term impact to your personal situation.

The National Association of REALTORS found that only 2 percent of first-time homebuyers used financial assistance, like a down payment program.

Yet, these programs may be your best bet. If you qualify, you keep your 401K intact and get help for your down payment and closing costs. You can also combine these programs with some of your own savings as well as low down payment first mortgages, helping you gain upfront equity and lower your monthly payment. Plus, many states also have tax credits that can help you save over the life of your loan.

The Bank of the West Millennial Study also reported that 68 percent of millennial buyers said they had home buying regrets, wishing they had been more prepared, had more money down or had better inspected the home before they bought it.

What can you do to be more prepared? First, hit pause on going to Sunday open houses and get your home financing in order. It will help you avoid home buying regrets later.

Consider signing up for homeownership counseling to get the education you need, now and investigate all your down payment options first.

Never want to miss a post? For more useful down payment and home buying information, be sure to subscribe to our mailing list.