Final 3 Down Payment Program Myths Debunked

Among life goals, homeownership is second only to retirement – ranking higher than getting married, having children and traveling the world, according to Bank of America’s Homebuyer Insights report. Where do you rank homeownership? If you’re here, you might agree that owning a home is a top priority.

Yet, you may be overlooking the wide range of resources available to help you achieve your homeownership dream — from homebuyer education to down payment help. Recent data shows just how many buyers may be leaving money on the table.

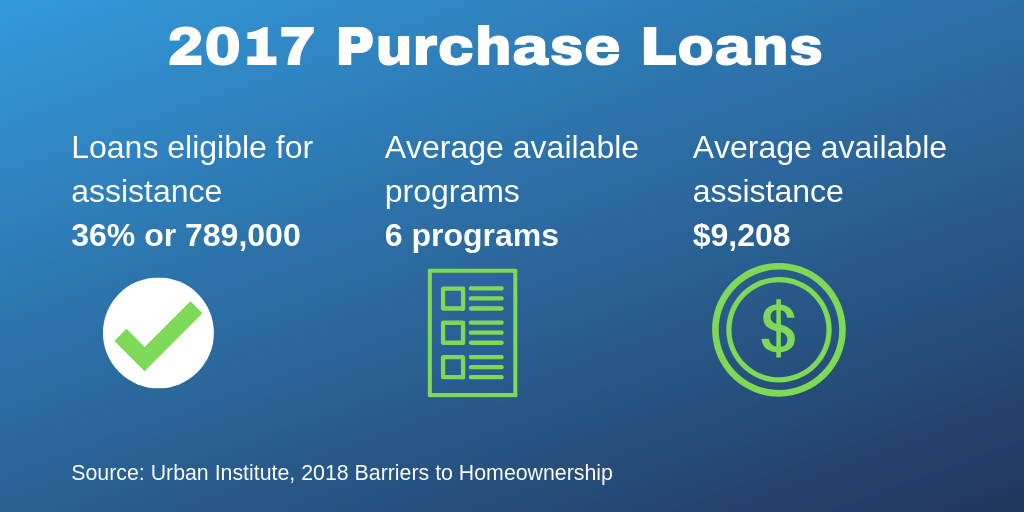

The Urban Institute’s Barriers to Homeownership Report looked at how many 2017 purchase mortgages would have been eligible for down payment help. Across 31 of the largest cities, about 36% or 789,000 loans were eligible for at least one homeownership program. The average loan was eligible for approximately 6 programs and $9,208 in down payment help. That’s valuable help that can help boost your homeownership potential.

Across the country there are more than 2,500 homeownership programs available to homebuyers – more than one program in every market. What can you do to be sure you don’t overlook an option for your personal situation?

Empower yourself as a homebuyer with these four important steps:

Never want to miss a post? For more useful down payment and home buying information, be sure to subscribe to our mailing list.