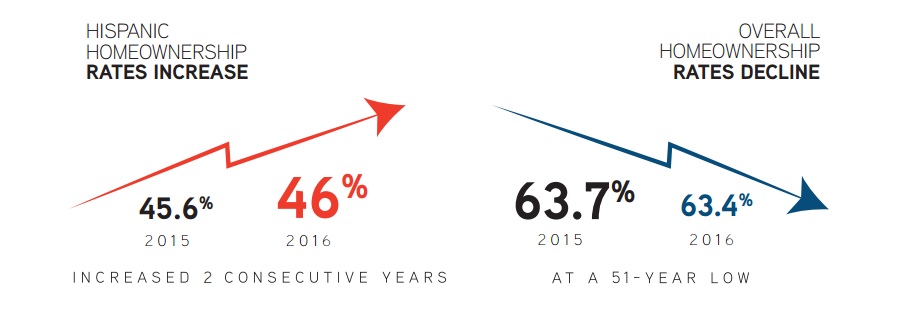

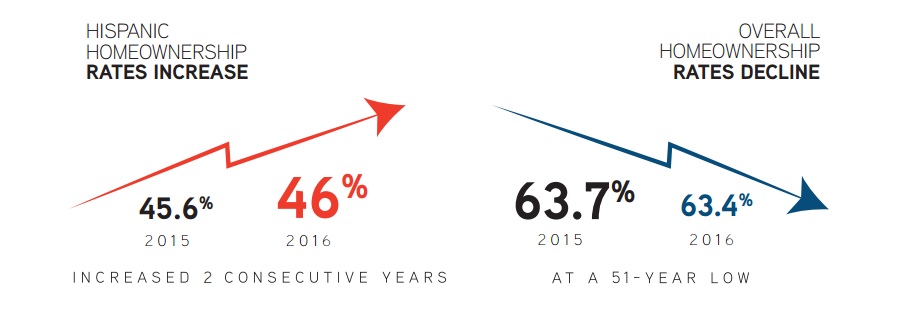

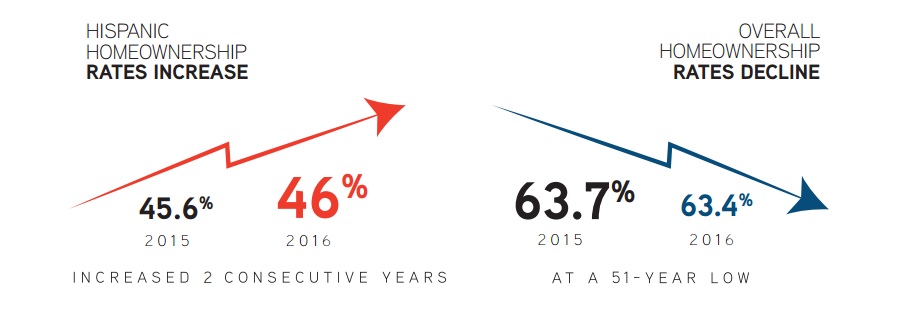

Hispanics are earning more money, becoming better educated, and forming households at a faster pace than any other demographic, according to the 2016 State of Hispanic Homeownership Report. They also continue to demonstrate a strong desire for homeownership and we can expect the rate to rise. The Hispanic community is already responsible for 75 percent of the country’s recent homeownership growth. In fact, while the overall homeownership rate declined to its lowest in more than 50 years, the Hispanic homeownership increased from 45.6 percent in 2015 to 46.0 percent in 2016.

Household formations up

In 2016, Hispanics accounted for 38 percent of new household formations in the country. Hispanics say raising a family and wealth creation are primary drivers of the desire to own a home, according to Fannie Mae’s National Housing Survey. Lenders and agents should take note of the particular needs and interests of Hispanic homebuyers, especially since 60 percent are Millennials.

3 big reasons Hispanic homeownership is increasing

The National Association of Hispanic Real Estate Professionals (NAHREP) outlined the top three reasons Hispanic homeownership is on the rise:

- Enthusiasm for homeownership: In the 2016 Fannie Mae National Housing Survey, 91 percent of Hispanics said they expect to be a homeowner at some point in the future and 87 percent view it as a good place for a family to raise children.

- Products and initiatives that better serve Hispanic homebuyers: More lenders and real estate service provides are developing products and services aimed at meeting the needs of Hispanic buyers. The report highlighted the Bank of America partnership with Down Payment Resource to implement an online tool that consumers and real estate professionals can use to identify down payment assistance programs available for borrowers. Bank of America is publicizing the availability of these resources by conducting a series of market events aimed at educating the real estate professionals who service Latino homebuyers.

- Professional networks: Groups like NAHREP create awareness, disseminate best practices and advocate for corporate and government policies that help guide the industry to better serve the growing Hispanic demographic. For example, select Hispanic-owned lenders were part of a Freddie Mac pilot program named “Your Path” that includes expanded guidelines for borrowers who have seasonal work or income from sources that are more difficult to measure using traditional methods.

Download the full report.

Download the full report.

Find the right down payment program for your needs.

Download the full report.

Download the full report.