Final 3 Down Payment Program Myths Debunked

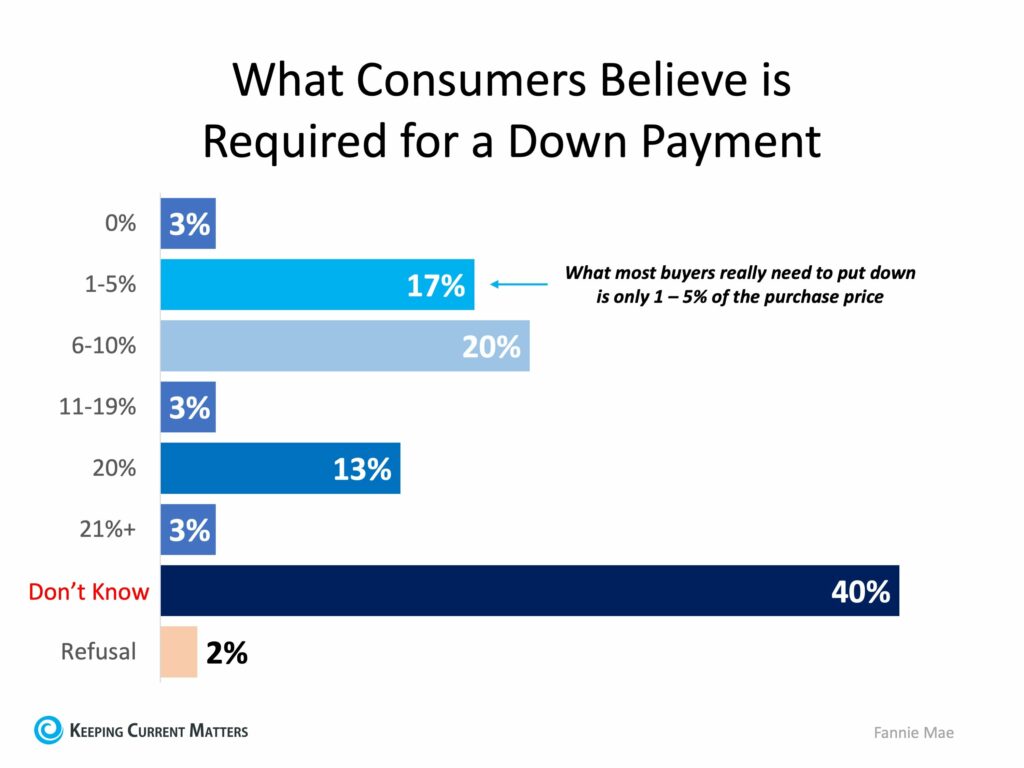

Homebuyer surveys report a big gap between perception and reality when it comes to down payments. And considering that saving for a down payment the number one challenge for new buyers, it’s probably time to brush up on your facts.

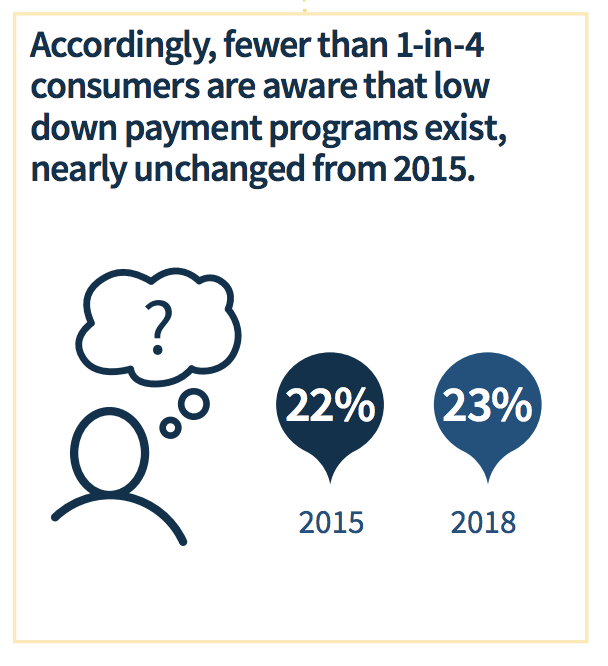

In fact, a new Fannie Mae consumer survey found little has changed in consumer knowledge from 2015 to 2018. Most buyers don’t know what’s required for a down payment and only 23% are aware of low down payment programs that could help them buy a home sooner.

What’s the median down payment?

What state has the highest median down payment?

How many states have homeownership programs?

What’s the minimum down payment required to qualify for a home loan?

What’s the average first-time homebuyer credit score?

Our friends at the Urban Institute developed a down payment quiz that promises to give you the right answer with helpful background if you miss a question…or two.

Ask your lender and real estate agent about low down payment programs and down payment assistance in your market. Shopping for a mortgage and doing your homework can pay off.

Never want to miss a post? For more useful down payment and home buying information, subscribe to our mailing list.