Final 3 Down Payment Program Myths Debunked

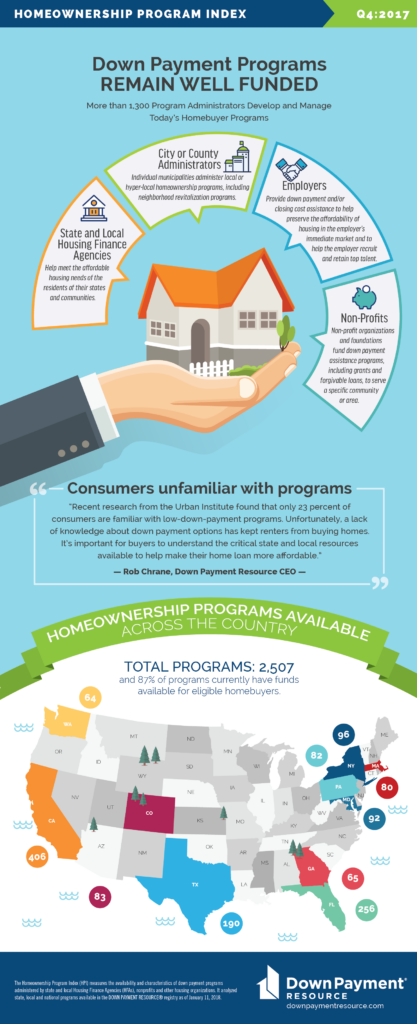

Our Fourth Quarter 2017 Homeownership Program Index (HPI) reports a new record high number of homebuyer programs — now 2,507 — available for today’s homebuyers. In addition, the programs remained well funded during 2017. More than 87 percent (87.4%) of programs currently have funds available for eligible homebuyers. While individual program funding can vary, overall funding trends for homebuyer programs across the country remain roughly unchanged from the previous quarter.

Down Payment Resource communicates with 1,309 program administrators to track and update the country’s wide range of homeownership programs, including down payment and closing cost programs, grants, Mortgage Credit Certificates, affordable first mortgages and more. This quarter’s HPI reviews the primary types of program administrators and funding sources that provide programs for today’s buyers.

“Recent research from the Urban Institute found that only 23 percent of consumers are familiar with low-down-payment programs. Unfortunately, a lack of knowledge about down payment options has kept renters from buying homes,” said Rob Chrane, Down Payment Resource CEO. “It’s important for buyers to understand the critical state and local resources available to help make their home loan more affordable.”

Homebuyer programs are managed and funded from a wide and diverse array of sources, each with its own requirements, nuances and limitations. The role of these administrators can vary, but generally, they approve participating lenders who are trained on the program guidelines and approved to originate, process and close specific homebuyer programs.

State and Local Housing Finance Agencies

State and Local Housing Finance AgenciesState Housing Finance Agencies (HFAs) are state-chartered authorities established to help meet the affordable housing needs of the residents of their states. These HFAs fund homebuyer programs through the use of housing bonds, housing credit, the HOME Investment Partnerships (HOME) program, and other state and federal funds. Many state HFAs use Private Activity Bonds to fund Mortgage Credit Certificate (MCC) programs, life-of-loan tax credits available to eligible buyers in most states. After concern late last year that the new tax bill would eliminate PABs, they were ultimately spared.

Individual municipalities administer local or hyper-local homeownership programs with funding from the U.S. Department of Housing and Urban Development (HUD). These may include neighborhood revitalization programs that are designed to help improve a specific area in the city or county.

The Community Development Block Grant (CDBG) program provides communities with resources to address a wide range of unique community development needs, and is one of the longest continuously run programs at HUD. The CDBG program provides annual grants on a formula basis to 1,209 general units of local government and states. HUD was also the administrator of Neighborhood Stabilization Program (NSP) funds. The federal government authorized three rounds of NSP funding during the mortgage crisis, and those funds were used to address blight, foreclosure and reinvestment in homeownership in markets hit hard by foreclosure.

Non-profit organizations and foundations fund down payment assistance programs, including grants and forgivable loans, to serve a specific community or area. For example, the Texas State Affordable Housing Corporation (TSAHC) is a non-profit organization that leverages private donations with its authority to sell tax-exempt affordable housing bonds to fund a wide range of housing programs.

Employers sometimes offer their own Employer Assisted Housing (EAH) programs to their employees, providing down payment and/or closing cost assistance to eligible current or incoming employees. The programs aim to preserve the affordability of housing in the employer’s immediate market and to help the employer recruit and retain top talent.

Download the full Fourth Quarter 2017 Homeownership Program Index press release.