Final 3 Down Payment Program Myths Debunked

Did you know the average down payment assistance benefit is more than $8,000? That could be a major jump start to buying your first (or next!) home. And, who wouldn’t want a boost to their down payment savings?

Homeownership programs can help you get in a house much more quickly and give you a valuable cash cushion for those other expenses, like the home inspection and home repairs. You could save on save on your down payment and closing costs, or even get ongoing tax credits.

First, it’s important to know that there are actually two components—both you and the the home you are buying must meet certain criteria, which vary by program. Our Down Payment Resource program search gives you the opportunity to answer a few simple questions to determine if you (and the home you want to buy) may meet the basic qualifications for a program.

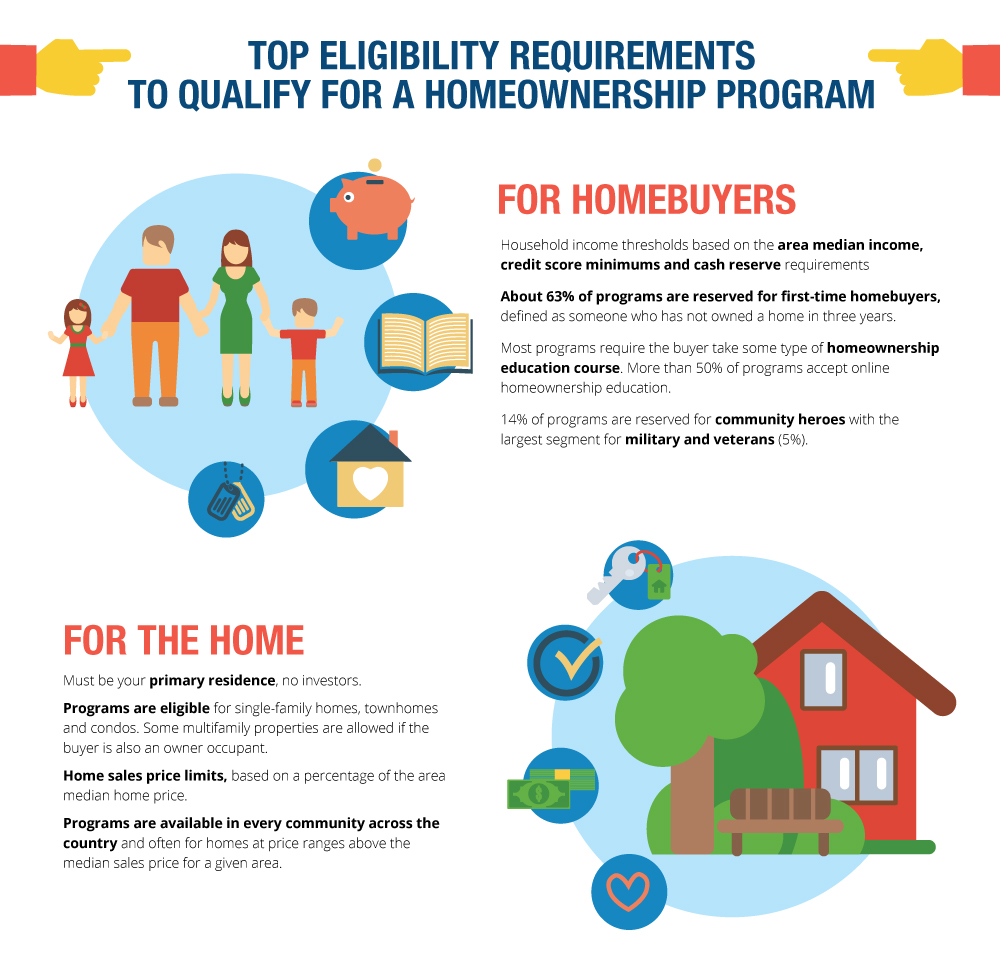

Family finances matter. There are household income thresholds, credit score minimums and cash reserve requirements. Income thresholds are based on the area median income—up to 120 percent in high cost markets. Income limits are almost always based on household size, so limits for a family of five are significantly higher than for a single person.

Most programs will require some money down from the homebuyer, as well as homebuyer education, especially for first-time homebuyers, to ensure your long-term homeownership success.

First-time homebuyer status. Many programs are designed for first-time homebuyers. But, keep in mind that first-time homebuyers are defined as someone who has not owned a home in three years, so if you’ve been renting for the past four years, you’re a first-time homebuyer again!

But, not all programs are reserved for first-timers—about 37 percent of programs in Down Payment Resource don’t include that requirement.

Your profession may give you an edge. More than 14 percent of programs are designed for individuals providing an important community service, including educators, protectors, healthcare workers and veterans. Especially helpful in high cost markets, the programs help workers live in the community they serve.

Must be your primary residence. Investors need not apply. Most housing agencies will require that the home is occupied as a primary residence in order to qualify. Programs are eligible for single-family homes, town homes and condos. Some multifamily properties are allowed if the buyer is also an owner occupant.

Home sales price. The home sales price criteria for programs are typically set based on a percentage of the area median home price. This means the home price limit can go from $250,000 up to well over 700,000 in certain high cost markets.

Programs available everywhere. Many homebuyers mistakenly believe down payment programs are available only in a very narrow area. In fact, programs are available in every community across the country and often for homes at price ranges above the median sales price for a given area.

Different geographies qualify for different programs. Down Payment Resource allows for search by city, county and neighborhood to help focus your opportunities.

Bottom line: The criteria can vary greatly so investigate the options for your personal situation.