A new report on credit access and affordability by the Urban Institute’s Housing Finance Policy Center commissioned by Down Payment Resource and Freddie Mac shows how many homebuyers could have taken advantage of down payment assistance and other affordable lending programs in 2016.

A new report on credit access and affordability by the Urban Institute’s Housing Finance Policy Center commissioned by Down Payment Resource and Freddie Mac shows how many homebuyers could have taken advantage of down payment assistance and other affordable lending programs in 2016.

The Barriers to Homeownership: Down Payments, Credit Access, and Affordability report provides data and commentary on three significant barriers to homeownership: saving for a down payment, accessing mortgage credit and housing affordability.

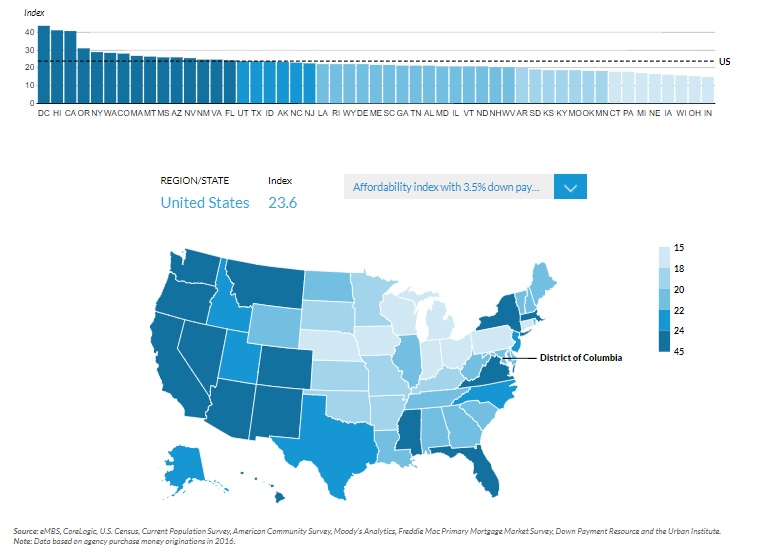

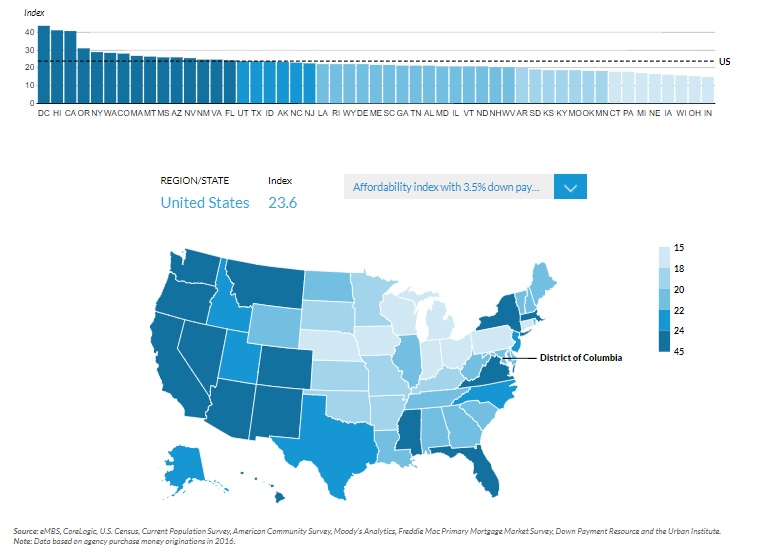

The report also offers information about down payment assistance programs which can help borrowers overcome that barrier. It includes an interactive map of the U.S. which allows users to compare 16 housing market factors, including homeownership programs, between states.

Report takeaways:

- The report analyzes the percentage of 2016 purchase mortgage originations that would have been eligible for potential down payment assistance programs. In New York City, for example, on average, homebuyers are eligible for eight homeownership programs with an average assistance of $13,484.

- More than half of renters state the down payment is the leading obstacle to homeownership.

- The median credit score for mortgages has increased 20 points over the past decade.

- Home price appreciation in the past five years and the recent increase in mortgage rates has brought national affordability back down to historical levels. Nationally, owning a home with a mortgage is more affordable than renting.

- We need to increase these programs’ visibility to ensure borrowers know about the assistance they could be getting.

- Educating consumers about low–down payment mortgages and down payment assistance is critical to ensuring homeownership is available to more families.

Find the right down payment program for your needs.

A new report on credit access and affordability by the Urban Institute’s Housing Finance Policy Center commissioned by Down Payment Resource and Freddie Mac shows how many homebuyers could have taken advantage of down payment assistance and other affordable lending programs in 2016.

A new report on credit access and affordability by the Urban Institute’s Housing Finance Policy Center commissioned by Down Payment Resource and Freddie Mac shows how many homebuyers could have taken advantage of down payment assistance and other affordable lending programs in 2016.