Final 3 Down Payment Program Myths Debunked

State housing finance agency (HFA) programs come with great incentives for low-to-moderate income first-time homebuyers, including a lower down payment and down payment or closing cost help. But, what about the old “skin in the game” argument?

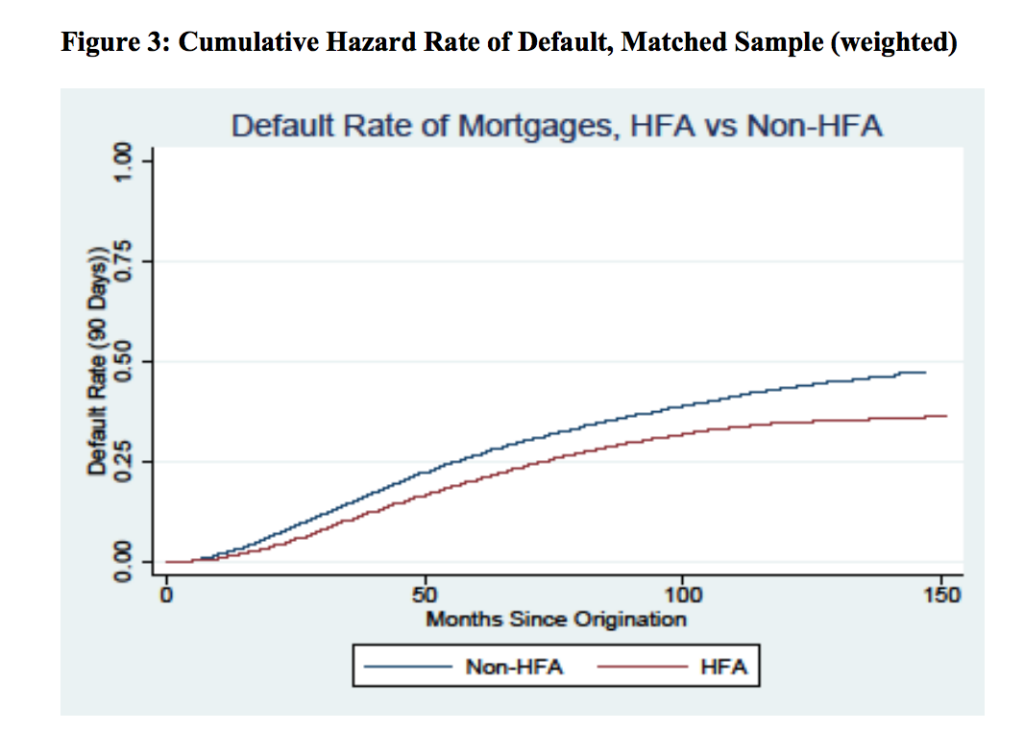

Some believe the only safe mortgages are those that require large down payments and loans with assistance are more risky. However, a new analysis shows that HFA loans may be less likely to default than conventional, private market mortgages.

A new working paper from authors from The Ohio State University, San Jose State University and the University of Chicago collected data from 1 million Fannie Mae single-family home purchase loans to low-to-moderate income first-time homebuyers to estimate the impact of HFA originations on loan performance. The loans were securitized between 2005 and 2014 and performance was tracked through September 2016.

The analysis indicated that HFA loans have a lower risk of default and foreclosure than loans originated to otherwise similar homebuyers. This means that through assistance, HFA borrowers are more likely to make mortgage payments, compared to other low-to-moderate-income borrowers.

The study shows loans originated through HFA programs are 20% less likely to go into default than for similar non-HFA homebuyers. They also have a 30% lower relative risk of foreclosure and the likelihood of prepayment is 30% lower.

The researchers also merged in data from the National Council of State Housing Agencies (NCHSA) annual State HFA Factbook to identify factors that result in better outcomes for the homebuyers. Preventive practices like loan education reduced the likelihood of default mortgages. And, loans originated by HFAs with direct servicing were less likely to experience default or foreclosure.

One of the big takeaways from this study is the importance of borrower screening and servicing practices. HFAs are more likely to require full documentation and careful underwriting, and they also serve as a third-party monitor on the partner lenders originating loans through the state program. This creates an additional incentive for careful screening by the participating lender.

These results highlight the potential role for policies that increase the transparency of lender origination practices and that incorporate mechanisms for monitoring by third-parties. There is also evidence that preventative servicing practices, for example making prompt contact with the borrower when a payment is missed, may reduce defaults and foreclosures. Early intervention when a borrower misses a payment may help improve mortgage success for low- to moderate-income homebuyers.

Read the full research paper.

Find your state HFA contact information and search for homeownership programs in your market.

Never want to miss a post? For more useful home buying information, be sure to subscribe to our mailing list.