Final 3 Down Payment Program Myths Debunked

Homeownership Program Index Reports Program Funding Down Nearly 3% While Down Payment Assistance Use Increases

Atlanta, GA, July 25, 2019 – Atlanta-based Down Payment Resource, the nationwide database for homebuyer programs, today released its First and Second Quarter 2019 Homeownership Program Index (HPI). The number of total programs decreased to 2,516, down just 8 programs from the fourth quarter of 2018. Nearly 83 percent (82.9%) of programs currently have funds available for eligible homebuyers, down 2.9 percent from the previous index.

Down Payment Resource (DPR) communicates with 1,248 program administrators to track and update the country’s wide range of homeownership programs, including down payment and closing cost programs, Mortgage Credit Certificates, affordable first mortgages and more.

View a complete list of state-by-state program data.

A common myth about homeownership programs is that they are only available to first-time homebuyers. Since the last HPI, the share of programs without a first-time homebuyer requirement increased to 41%, up 2% from the previous HPI. This means more homeownership programs can serve repeat and move-up buyers. Most programs use HUD’s definition of a first-time homebuyer — someone who has not owned a home in the past three years.

The HPI reports the share of funded programs decreased by nearly 3% since the Fourth Quarter 2018 report, primarily due to the sunsetting of many Neighborhood Stabilization Programs (NSP) designed to positively impact areas hardest hit by foreclosures. In addition, federal funds for government programs are issued later in the summer so some funds are not currently active.

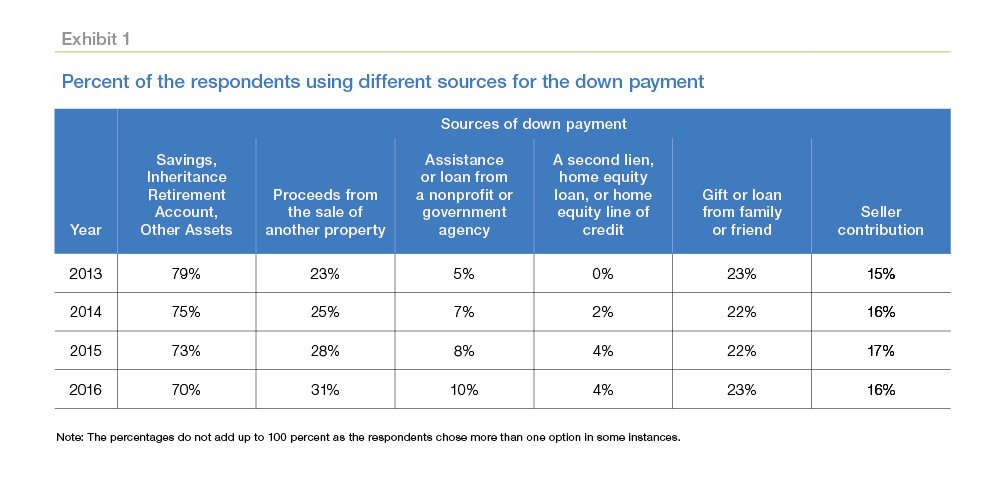

There are new signs that more homebuyers are accessing down payment assistance funds. Data from National Survey of Mortgage Originations and Freddie Mac found that buyers using down payment assistance as a source for the down payment doubled in four years, between 2013 – 2016. With new buyers coming to market who don’t have proceeds from a home sale to fund their down payment, down payment program use may be poised for continued growth. In addition, FHA reports that more than 13% of borrowers who used an FHA loan so far in 2019 received government help with the down payment.

“It’s encouraging to see more homebuyers accessing the down payment help they need to make homeownership more affordable,” said Rob Chrane, CEO of Down Payment Resource. “We track a wide range of eligibility criteria and benefit details about today’s programs, including whether or not a program has funds available for buyers. It’s information that helps housing professionals and homebuyers easily identify opportunities that will work for their situation.”

View state-by-state data.

Download the infographic and press release.